main content of page

Kawasaki Motors Retail Finance, LLC. |

Notice Regarding a Capital and Business Alliance to Strengthen the Business of a Subsidiary (Kawasaki Motors, Ltd.)

Kawasaki Heavy Industries, Ltd. (hereinafter, "the Company") has resolved, at its Board of Directors meeting held on November 8, 2024, that the Company will sell 20% of the outstanding shares of its consolidated subsidiary Kawasaki Motors, Ltd. (hereinafter, "Kawasaki Motors") owned by the Company to Kawasaki Motors as described below, and that Kawasaki Motors will conduct a third-party allotment to ITOCHU Corporation (hereinafter," ITOCHU") whereby 20% of the outstanding shares of Kawasaki Motors will be allocated to ITOCHU. Along with the resolutions, the three companies entered into a capital and business alliance agreement on the same date. The following document is intended to provide notice of these events.

-

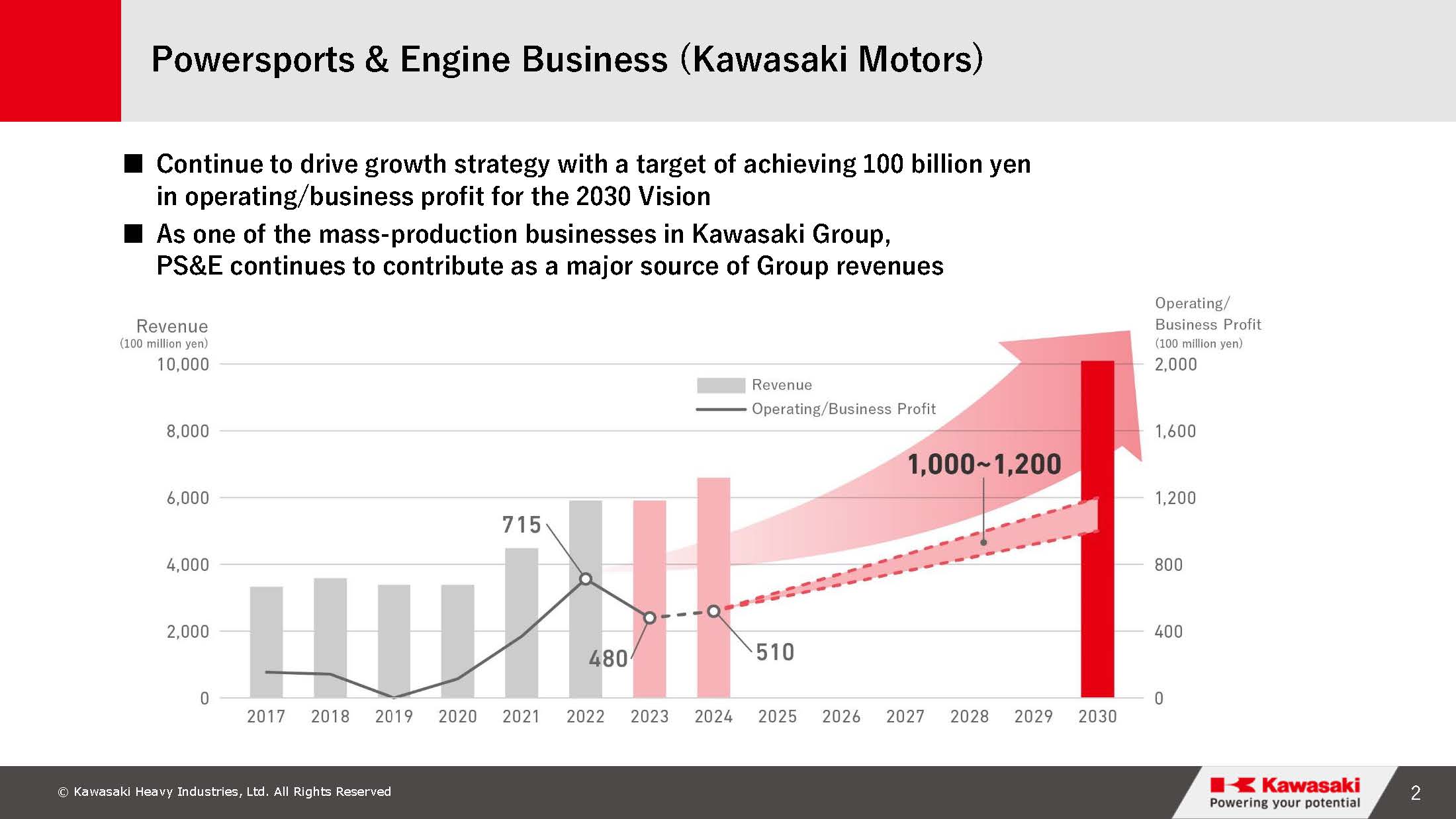

The Objectives of the Capital and Business Alliance

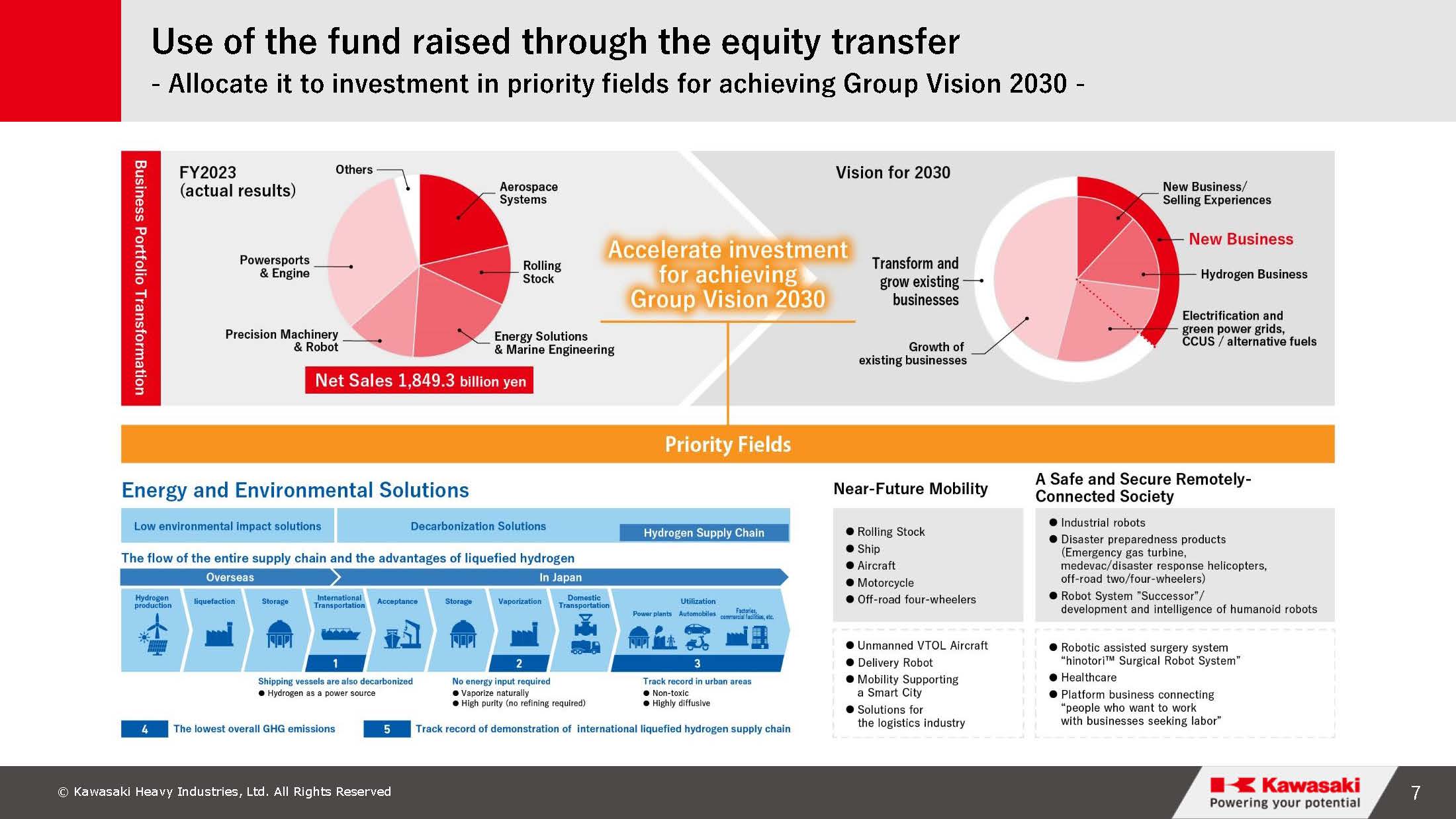

In order to realize the "Group Vision 2030" enacted in fiscal year 2020, the Company has been stepping up efforts to offer solutions to address social issues as well as to build an operating system and growth scenarios for generating such solutions. As a part of this process, and while Kawasaki Motors is executing various management measures to achieve its target of one trillion yen in net sales, the three companies have been engaging in discussions concerning the possibility of collaboration that utilizes their respective resources and have reached an agreement under which the companies will work together through closer collaboration with ITOCHU as a medium and long-term partner in the Powersports & Engine business, aiming to promote personnel exchanges among the companies and to pursue mutual growth strategies.

Through this alliance, the companies will establish a system enabling them to provide financial services directly to users within the North American market, which is the world’s largest market and the priority market for Kawasaki Motors, in a bid to enhance resilience against changes in market conditions and further strengthen its sales base, thereby accelerating and strengthening the growth strategies of Kawasaki Motors. As background, ITOCHU has built a collaborative relationship with Kawasaki Motors in helping promote exportation and manage European sales operations since the initial stages of overseas expansion of Kawasaki Motors’ motorcycle business that began in the 1960’s and has a deep understanding of Kawasaki Motors’ businesses. Besides, ITOCHU has been driving growth investment and business expansion with a focus on downstream businesses closer to consumers, and has extensive knowledge and expertise required to operate financing businesses based on its own operational experiences in sales finance services.

The Company also believes that this alliance bears great significance for the entire Group of the Company, as the fund to be raised this time will help the Company make further investment in the hydrogen business and two other business identified as focal fields in our Group Vision 2030. Leveraging the alliance, the Company will accelerate investments in growth areas, aiming to realize sustainable growth for the Group as early as possible while improving overall capital efficiency and financial strengths of the Group with a more appropriate balance sheet structure.

-

Details of the Capital and Business Alliance

-

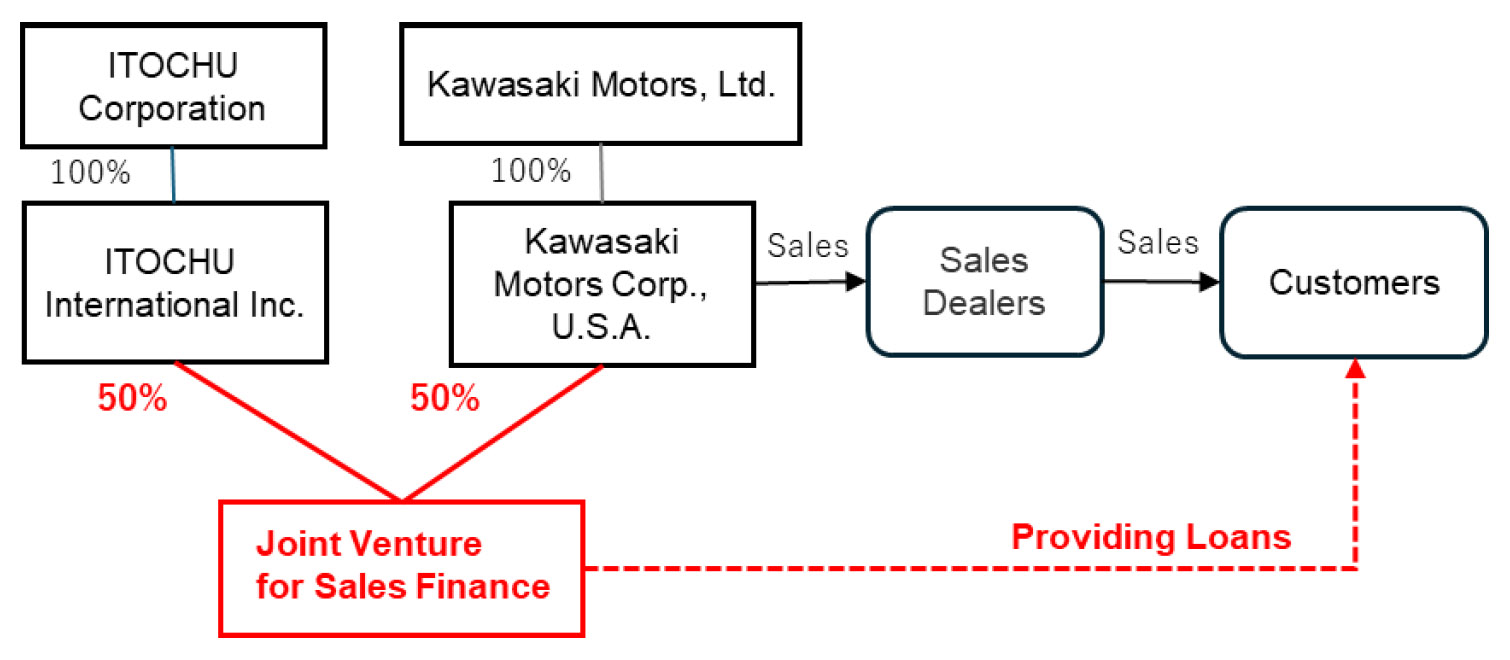

Establishment of a joint venture for the purpose of providing sales finance services

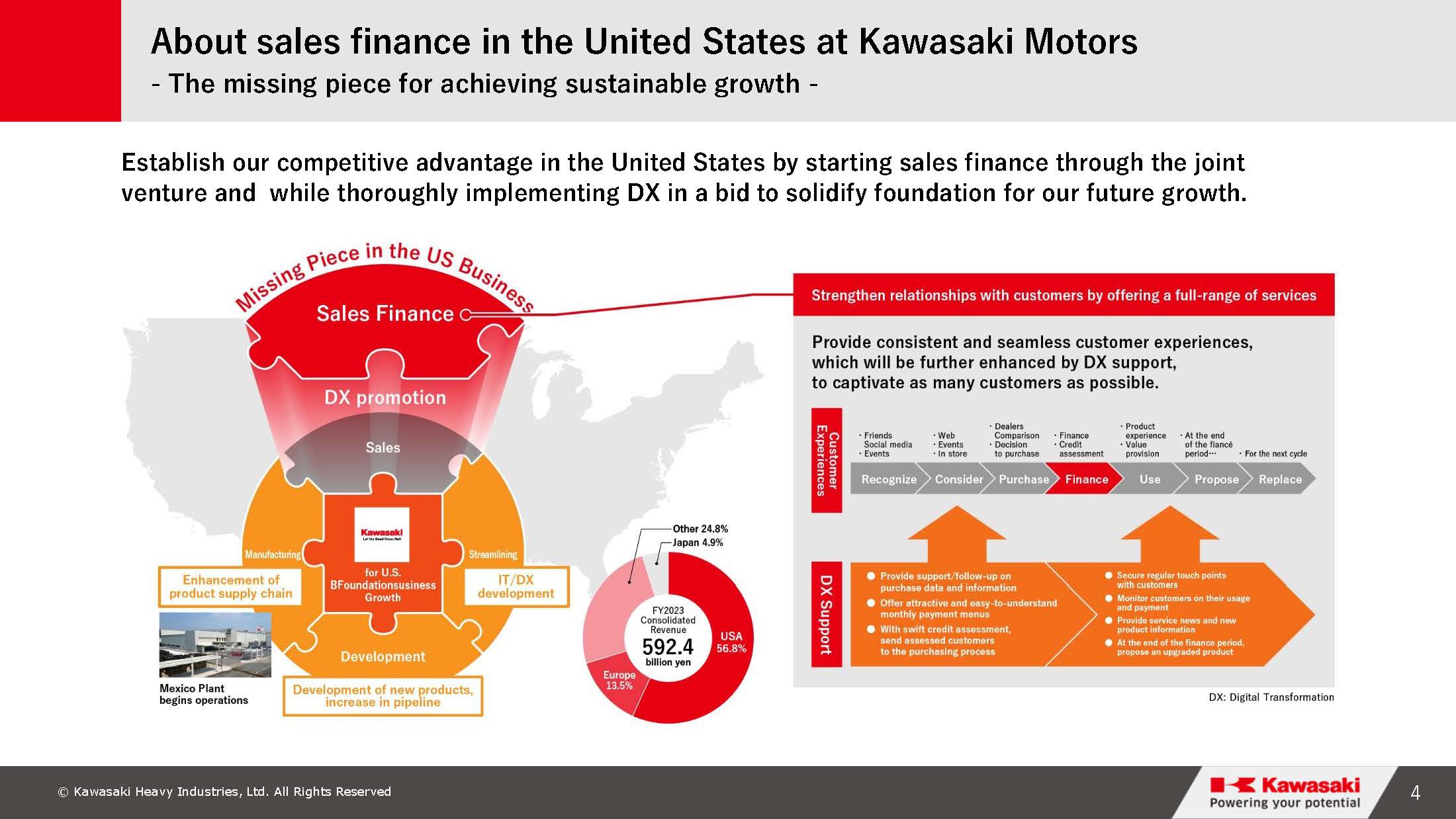

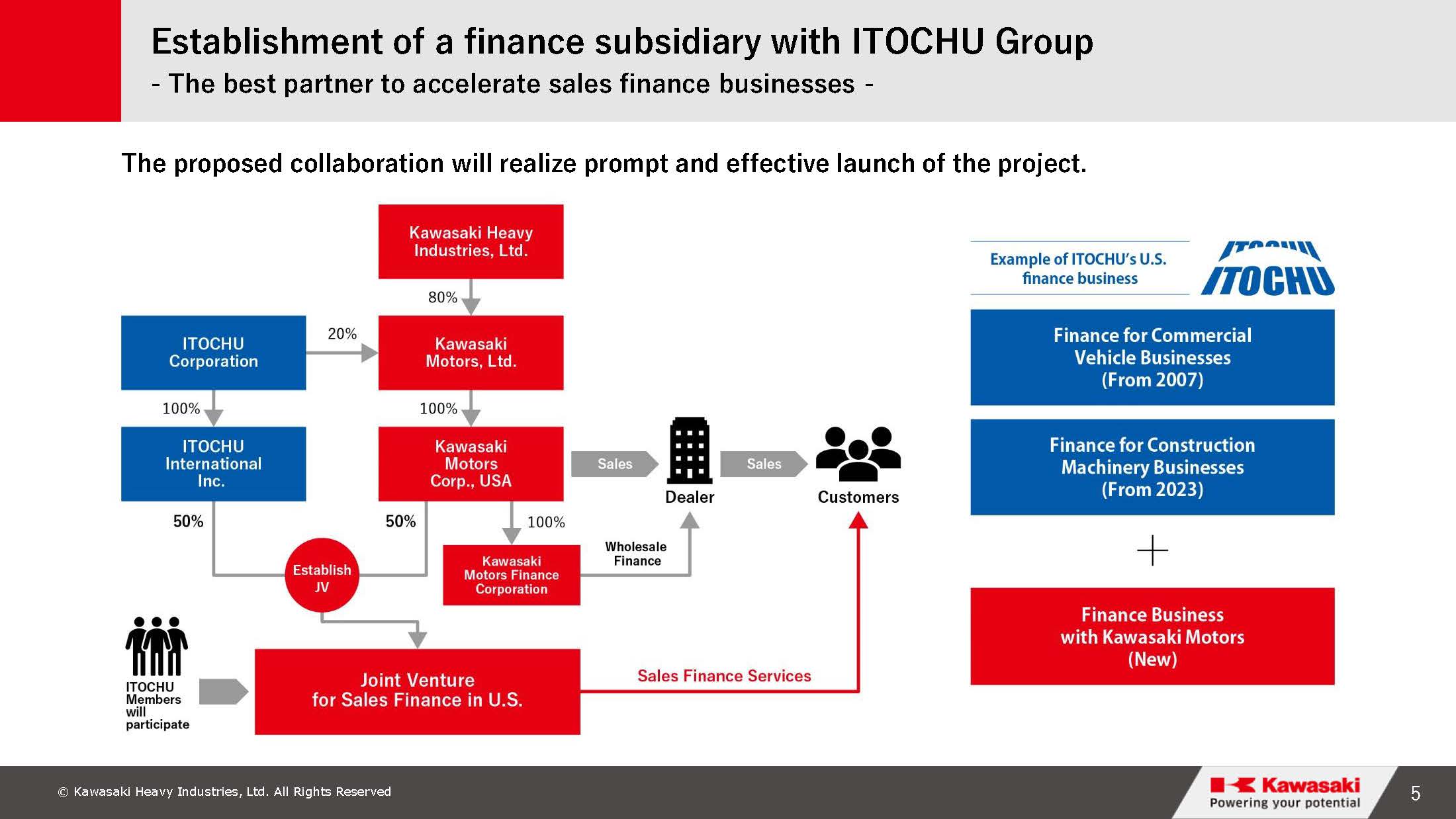

Kawasaki Motors and ITOCHU will first establish a joint venture company that will provide sales finance services aimed at the U.S. market.

As there is high customer demand in the U.S. market for long-term installment payments when purchasing powersports products, there is a need to provide quick screening processes and competitive financing menus for dealers and customers.

By providing high quality financial services via a market-in approach in parallel with efforts to implement an appealing, new model, and thus further expanding the sales of the products and services of and extending the value chain in the U.S., the joint venture company will help strengthen Kawasaki Motors’ customer base fundamentally and solidify its competitive advantage in the U.S. market, which accounts for more than half of Kawasaki Motors’ sales.

The scheme for the sales finance services will be as follows:

-

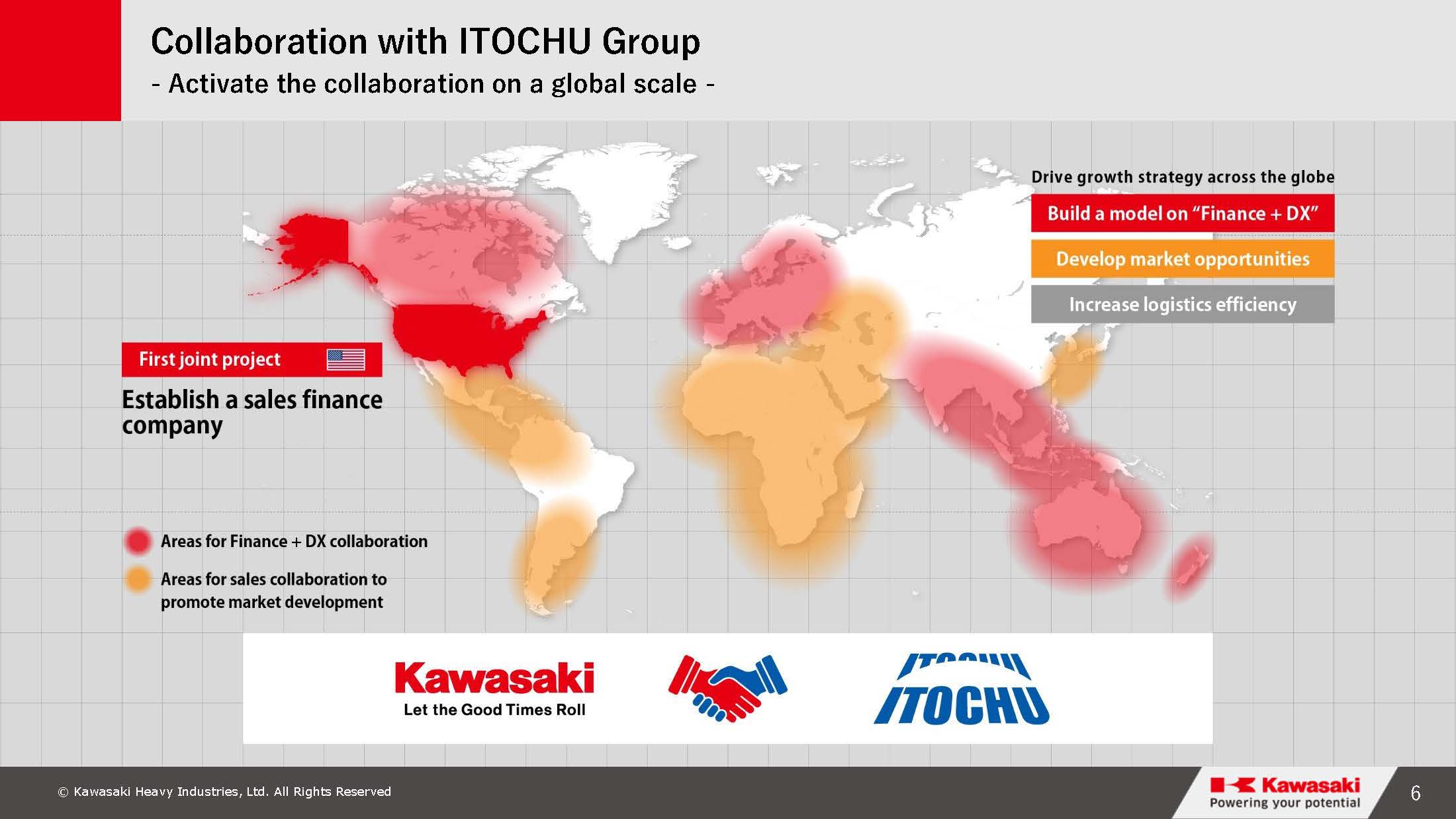

Joint efforts for global sales cooperation and logistics efficiency

Kawasaki Motors and ITOCHU will promote the global expansion of powersports products through proactive personnel exchanges between the two companies and the active use of ITOCHU's global bases of operation.

The two companies intend to capture greater demand in countries where Kawasaki Motors has not yet fully penetrated, starting with the new markets of the CIS, the Middle East, Africa, and Latin America, where ITOCHU possesses deep knowledge based on its commitment to automotive businesses, while making efforts to improve overall logistics efficiency by leveraging land-sea transport logistics network of ITOCHU group companies.

-

Details of the capital alliance

① In order to maximize the effect of this broad business alliance described above, besides establishing the aforementioned joint venture company, the parties will form a capital alliance in which ITOCHU will own a part of Kawasaki Motors' shares as follows.

-

In order for Kawasaki Motors to acquire its own shares held by the Company through a share buyback, the Company will transfer 4,000 ordinary shares to Kawasaki Motors (hereinafter, "Share Transfer").

-

Kawasaki Motors will conduct a third-party allocation of 4,000 ordinary shares to ITOCHU as the underwriter (hereinafter referred to as the "Third-party Allotment").

-

Based on the results of (i) and (ii) above, the Company will hold 80% of the voting rights of Kawasaki Motors, while ITOCHU will hold 20%.

② Overview of the Share Transfer

(1) The number of shares retained by the Company prior to the Share Transfer

20,000 shares (100% voting rights ownership)

(2) Number of shares to be transferred

4,000 shares

(3) Transfer price

80 billion yen

(4) Date of transfer

April 1, 2025 (expected)

③ Overview of the Third-party Allotment

(1) Number of shares to be allotted

4,000 shares (100% voting rights ownership)

(2) Amount to be paid in

80 billion yen

(3) Number of shares issued after the allotment

20,000 shares

(4) Date of payment

April 1, 2025 (expected)

(5) The number of shares retained by the Company following the Share Transfer and the Third-party Allotment

16,000 shares (approximately 80% voting rights ownership)

-

-

-

Overview of the subsidiary

(1) Name

Kawasaki Motors, Ltd.

(2) Location

1-1 Kawasaki-cho, Akashi-shi, Hyogo 673-8666, Japan

(3) Job title and name of representative

Hiroshi Ito, Representative Director, President and Chief Executive Officer

(4) Description of business

Motorcycle & Engine business

(5) Share Capital

1 billion Japanese Yen

(6) Date of Establishment

February 12, 2021

(7) Major shareholders and ownership ratios

Kawasaki Heavy Industries, Ltd. (100%)

(8) Relationship between the Company and the subsidiary

Capital relationship

The wholly owned subsidiary of the Company.

Personnel relationship

Four executive officers of Kawasaki Heavy Industries are also directors and corporate auditors, etc. of Kawasaki Motors.

Business relationship

-

(9) Operating results and financial positions of the subsidiary for the last three years

Years ended March 31

2022

2023

2024

Net assets

58,675 million yen

107,707 million yen

125,846 million yen

Total assets

176,173 million yen

235,526 million yen

269,837 million yen

Net assets per share

2,933,750.18 yen

5,385,373.31 yen

6,292,343.88 yen

Net sales

148,355 million yen

364,175 million yen

363,944 million yen

Operating profit

8,198 million yen

47,533 million yen

40,902 million yen

Ordinary profit

10,443 million yen

69,653 million yen

39,704 million yen

Profit

7,200 million yen

56,093 million yen

33,979 million yen

Earnings per share

714,802.34 yen

2,804,668.52 yen

1,698,991.92 yen

Dividend per share

360,010.19 yen

0 yen

872,900.00 yen

-

Overview of the counterparty to the capital and business alliance

(1) Name

ITOCHU Corporation

(2) Location

1-3, Umeda 3-chome, Kita-ku, Osaka, 530-8448, Japan

(3) Job title and name of representative

Keita Ishii, Representative Director, President & Chief Operating Officer

(4) Description of business

General trading company

(5) Share Capital

253,448 million yen (as of the year ending March of 2024)

(6) Date of Establishment

December 1, 1949

(7) Major shareholders and ownership ratios

The Master Trust Bank of Japan, Ltd. (trust account)

16.09%

BNYM AS AGT / CLTS 10 PERCENT

9.04%

Custody Bank of Japan, Ltd. (trust account)

5.30%

CP WORLDWIDE INVESTMENT COMPANY LIMITED

3.91%

Nippon Life Insurance Company

2.36%

Mizuho Bank, Ltd.

2.17%

SSBTC CLIENT OMNIBUS ACCOUNT

1.91%

STATE STREET BANK WEST CLIENT - TREATY 505234

1.75%

Asahi Mutual Life Insurance Company

1.62%

JP MORGAN CHASE BANK 385781

1.30%

(as of March 2024)

(8) Relationship between the Company and the counterparty

Capital relationship

Not applicable

Personnel relationship

Not applicable

Business relationship

The Company and its affiliates have transactions such as purchasing materials and leasing with the counterparty and its affiliates.

Status of applicability torelated parties

Not applicable

(9) Consolidated operating results and consolidated financial positions of the counterparty for the last three years

Years ended March 31

2022

2023

2024

Total shareholders’ equity

4,199,325 million yen

4,823,259 million yen

5,426,962 million yen

Total assets

12,153,658 million yen

13,115,400 million yen

14,489,701 million yen

Shareholders' equity per share

2,857.50 yen

3,314.35 yen

3,771.77 yen

Revenues

12,293,348 million yen

13,945,633 million yen

14,029,910 million yen

Trading income

582,522 million yen

701,913 million yen

702,900 million yen

Profit before tax

1,150,029 million yen

1,106,861 million yen

1,095,707 million yen

Net profit attributable to ITOCHU

820,269 million yen

800,519 million yen

801,770 million yen

Basic earnings per share attributable to ITOCHU

552.86 yen

546.10 yen

553.00 yen

Dividend per share

110 yen

140 yen

160 yen

-

Timetable

(1) Date of resolution at the meeting of the Board of Directors

November 8, 2024

(2) Date of conclusion of the agreement

November 8, 2024

(3) Effective date

April 1, 2025 (expected)

-

Future outlook

Although this alliance will not have any effect on the results for the current fiscal year, we believe that conducting business development based on this capital and business alliance will contribute toward the improvement of the performance of the Company and Kawasaki Motors over the medium-to-long term. In addition, we expect that the impact of the execution of the Share Transfer will be a recording of approximately 70 billion yen in extraordinary income for the non-consolidated financial results of the Company for the year ending March of 2026. However, as Kawasaki Motors will remain a consolidated subsidiary of the Company even after this transaction, we expect that the impact on consolidated profit and loss will be minor.